Online health-insurance exchange will differ in several ways from those in other states; scheduled to go online Oct. 1

The state is writing regulations to govern the operations of the exchange, and “developing IT systems that house and execute the eligibility determination rules for exchange coverage, federal premium tax credits and cost-sharing subsidies, Medicaid, and the Children’s Health Insurance program” says the Georgetown University report, prepared for the Commonwealth Fund, which calls itself “a private foundation that aims to promote a high-performing health care system.”

Most states are involving their legislatures in decisions about exchanges, says the report. This is not the case in Kentucky, perhaps because Republicans control the state Senate. Tea party activist David Adams has filed suit, challenging the legality of Gov. Steve Beshear’s decision to implement the exchange without legislative approval. So far, a judge has denied the governor’s request to dismiss it.

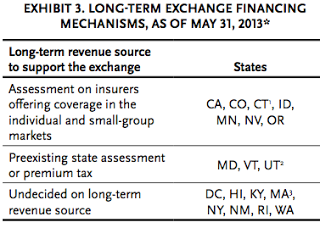

Even the exchanges with their own rulemaking authority like Kentucky have worked with the legislatures for other decisions, “such as the exchange’s long-term financing mechanisms,” says the report. The federal funding Kentucky is using to establish the exchange will be gone by 2015, but as of May 31, Kentucky and seven other states had no plans for a long-term revenue source. Other states have either assessed insurers offering coverage on the exchanges or they are assessing taxes to cover the cost, says the report. Kentucky officials have indicated they will use assessments, but some Republicans have said that would be a tax, which only the General Assembly can impose.

Even the exchanges with their own rulemaking authority like Kentucky have worked with the legislatures for other decisions, “such as the exchange’s long-term financing mechanisms,” says the report. The federal funding Kentucky is using to establish the exchange will be gone by 2015, but as of May 31, Kentucky and seven other states had no plans for a long-term revenue source. Other states have either assessed insurers offering coverage on the exchanges or they are assessing taxes to cover the cost, says the report. Kentucky officials have indicated they will use assessments, but some Republicans have said that would be a tax, which only the General Assembly can impose.

The report also highlights the various approaches states have taken to toward selection of exchange plans. Kentucky is called a “market organizer,” meaning that it “manages plan choices through limits on the number or type of plans that an insurer can offer but does not selectively contract with insurers,” says the report. As required by the health-reform law, the Kentucky exchange will require participating insurers to offer at least “silver” and “gold” plans, and it is also requiring them to offer catastrophic coverage outside the metal-labeled tiers (which could have included “bronze”).

Kentucky opted for

no more than four plans per metal tier. Officials say limiting the number of plans will help consumers avoid being overwhelmed while giving insurers flexibility. Although the employer mandate to provide health insurance was delayed until 2015, Kentucky’s exchange is still expected to offer multiple tiers through multiple insurers for employers to buy insurance, says the report.

On the advice of a 19-member board Beshear appointed to oversee the exchange, Executive Director Carrie Banahan has decided to not require plans to display quality metrics, as 10 other states plan to do, the report says. The board is chaired by Sharon Clark, commissioner of the Kentucky Department of Insurance.

The board and Banahan have gone against the grain on some other decisions. Most states are deferring to existing rules governing insurance agents; Kentucky is the only state requiring all agents to represent at least two insurers participating in the exchange.

In June, the state Cabinet for Health and Family Services issued a request for “Kynectors” to help Kentuckians shop for health insurance on the exchange. These employees and volunteers will help individuals and small businesses in determine their health-plan needs and help them choose plans to meet those needs, the cabinet said. To view the solicitation for Kynectors, click here.

|

| The state is currently looking for exchange “kynectors” |

Information for the report was gathered from minutes of the board. Click here for a list of board members and here to view board meeting materials. Minutes of the May meeting will be posted after the board’s next meeting on July 15, Midkiff said.