Workers, employers blame Obamacare for higher premiums, but experts say the causes are a lot more complicated than that

Kentucky Health News

While the main provisions of the federal health-reform law are only now taking effect, some Americans are already saying it doesn’t work and are blaming it for higher insurance premiums and deductibles. But the cause and effect are uncertain.

“The connection between the new benefit plans and the new law isn’t as clear as it might seem . . . because many of the coming benefit changes have been talked about and embraced by companies for years, long before Obamacare became an emotional and political lightning rod,” reports Dan Horn of The Kentucky Enquirer.

As they renew or enroll in employer health plans, workers are taking note of unwelcome changes, including new fees and surcharges, more high-deductible plans, bigger penalties for not participating in wellness programs, and the elimination of benefits for spouses, Horn writes.

“The law represents the most profound change to the nation’s health care system in decades, and uncertainty over its provisions has made both businesses and individuals nervous,” Horn reports. “With the [employer] mandate on hold, most companies get another year before the Affordable Care Act changes the game.”

Nearly one in five Americans believe their health insurance costs have gone up because of Obamacare, says CNBC’s third quarter All-America Economic Survey.

Actual health-insurance premiums to cover working Americans rose 4 percent this year, less than in the previous two years, says the Kaiser report. Slow premium growth indicates a slowdown in health benefit costs for U.S. companies, which economists attribute to an overall economic slowdown. And, the tepid economic recovery and decline in personal wealth continues to impact the health sector, says a recent Price Waterhouse Cooper Health Research Institute report.

Shifting costs to employees

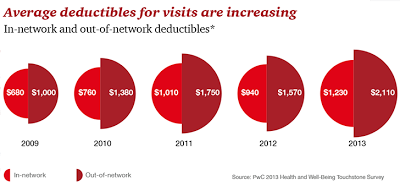

While premiums may be rising more slowly for employers, they could be rising more rapidly for workers because employers’ insurance plans are shifting more costs to workers. Many companies are moving to high-deductible plans that require employees to pay a larger share of their costs.

The Pricewaterhouse Coopers report said in 2013 that the number of employers offering only high-deductible plans increased 31 percent over 2012, and another 44 percent of employers are considering the move for 2014. Transitions to high-deductible plans can affect health care costs; when consumers pay more for their health care, they often make more cost-conscious choices.

“Businesses have been shifting more of the costs of health insurance to workers through premiums, deductibles and other cost-sharing,” said Drew Altman, Kaiser Family Foundation CEO. “From a consumer perspective, the cost of health insurance just keeps going up faster than wages.”

Over the last decade, premiums have risen almost three times as fast as wages or inflation. The average premium for family coverage has increased 80 percent, and worker contribution has increased 89 percent over the past decade and 14 percent more than in 2009, says the Kaiser report.

A new study by the Kaiser foundation says the economy has had the biggest influence on health care utilization and spending.

It says adjustments to health benefit plans have been slowly occurring over the past decade, well before Obamacare became policy, and economic conditions may influence workers’ perception of health insurance costs. “We’re seeing that the continued economic downturn is leading to more burden for employees,” said Gary Claxton, vice president of the foundation.

The economic decline has put pressure on companies to reduce overall costs and pass along the expense of health insurance to the employees, said Claxton. Companies have been trimming benefits and implementing cost-saving and cost-control measures for some time, but many still blame these unpopular measures on Obamacare. “Why wouldn’t you?” he asked.

Proponents of Obamacare say it’s actually helping control costs. Even if it isn’t now, it will eventually, Claxton told Drew Armstrong of Bloomberg in a conference call. His boss agrees.

“Historically, we have always seen the health-care marketplace respond by lowering costs when there is the threat of impending health reform legislation or government action on costs,” Altman wrote in a recent column for Politico. “Now we have not only the threat but the reality,”

Big changes are on the way

The health law builds on employer-sponsored insurance, but since it makes such big changes to the system, some are questioning how it will impact the employers’ role in providing insurance. A study by the RAND Corp. says that through state insurance exchanges’ putting employees of small firms into a single risk pool, Obamacare could alleviate some of the difficulties faced by small firms that want to offer insurance.

Many people are concerned that the law may cause employers to stop offering health insurance. The RAND study predicts the opposite, saying that the number of workers offered coverage will increase from 115.1 million (84.6 percent of the approximately 136.0 million U.S. workers) to 128.7 million (94.6 percent ) after the reform.

The large increase in coverage will stem from small business coverage, which will be driven by a greater demand for coverage by workers due to individual penalties for being uninsured and the availability lower-cost insurance options, says the RAND study.

However, health plans may look different than those before the health law passed. The state exchanges allow an employer to provide employees with more plan options. The Kaiser report notes that the exchanges encourage employers to deliver health benefits in a lump sum that employees can use to buy insurance through the exchange.

Another trend tied to the law is the proliferation of employee wellness programs. New federal rules for such programs allow employers to have larger financial rewards for employees who participate in them, and allow employers to penalize employees for specific behaviors, such as smoking.

Horn, writing in the Enquirer, says companies have embraced wellness programs as a way to offset costs: “No matter where they stand with the law, companies are constantly looking for new ways to save on health care.”

These health-benefit approaches, just like the premiums paid for the plans, will vary with each exchange. Kaiser says the common theme is to give employees choices, along with financial responsibility for those choices. The fact is, as a result of the health law, some Americans will pay more for health insurance and some will pay less.

“Whether this new way of purchasing coverage works for employers and their employees, and how it affects benefits and plan costs, will be among the more important stories for the employer health insurance market over the next few years,” says the Kaiser report.