15 to 25% of uninsured Kentuckians may be eligible for free, non-Medicaid coverage, but watch those out-of-pocket costs

An analysis by an independent consulting firm, McKinsey and Co., found that 5 to 6 million uninsured Americans will qualify for subsidies greater than the cost of the cheapest “bronze” or “silver” plan. However, many insurers have been careful not to publicize this free coverage because these plans have high out-of-pocket costs and some people will be better off paying higher premiums to get more coverage, reports The New York Times.

In a zero-net-premium plan, the federal subsidy covers the entire premium, but many people still face significant out-of-pocket costs for health services. Most zero-net premium plans are bronze plans, which are the least expensive available on exchanges and cover about 60 percent of a person’s medical costs; the consumer must pay for the remaining 40 percent. So, choosing this type of plan means that you may sacrifice coverage compared to other plans on the exchange.

As the metal level increases in value from bronze to platinum, so does the percentage of medical expenses that the plan will cover. Silver plans cover about 70 percent, gold plans cover about 80 percent and platinum plans cover about 90 percent of medical costs. Regardless of the plan tier, all plans must cover standard benefits like prescription drugs, maternity care and mental health treatment. Preventive services are free in all plans.

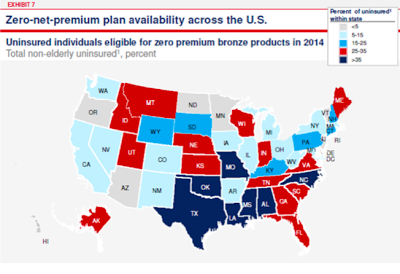

The McKinsey report says 15 to 25 percent of Kentucky’s non-elderly uninsured will be eligible for a zero-net-premium plan that will either be a bronze or silver plan. Nationwide, about half of the individuals who qualify for a zero-net-premium plan are younger than 39 and are uninsured.

Individuals with lower incomes are more likely to be eligible for these plans and most will have income levels not far above the Medicaid coverage threshold, which is 138 percent of the federal poverty level. Remember persons with income up to 400 percent of the poverty line qualify for federal tax subsidies to assist with premium payment.

Experts say the higher deductibles and higher annual out-of-pocket costs of the bronze plans may not be suited for someone with a lower income. “They may be getting zero premiums, but they’re also leaving a lot of money on the table if they don’t enroll in a silver-level plan,” Sabrina Corlette, a professor at Georgetown University’s Health Policy Institute told The New York Times.

Low-cost plans may encourage younger, healthier people to enroll in Obamacare, but they have the highest out-of-pocket cost limit and highest deductible amounts. Out-of-pocket costs, including the deductible, co-payments and co-insurance (a percentage of charges), are limited to $6,350 for individuals and $12,700 for families in bronze plans. So, for some, the silver plan may be a better option, and some individuals may also qualify for a zero-net premium silver plan.

When choosing a lower-tier plan, be ready for significant cost sharing, and be careful to check that your doctors and nearby hospitals are in the plan’s network. When it comes to health insurance coverage, for individuals who don’t qualify for programs like Medicaid and Medicare, there’s free coverage but no free lunches.