Shopping for health insurance is hard; understanding it is even harder, even for some who already have it, research shows

only one big hurdle behind them. The next is understanding how the plan

works.”

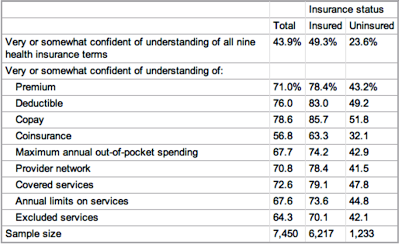

Many of the newly insured are likely to stumble on that hurdle, Kliff writes, citing new research showing that “Fewer than one in four uninsured Americans felt confident they

understood nine basic insurance terms like ‘premium,’ ‘co-insurance’ and ‘maximum out-of-pocket’ charges.” But many people who have had coverage also said they lacked a good handle on

the nine terms.

“Confusion around these concepts would make it difficult for consumers

to understand trade-offs between different health insurance plans,” Sharon Long of The Urban Institute and her co-authors wrote in the

journal .

“Low health literacy could reduce the gains for consumers,

particularly…if the consumers who do enroll face unexpected

out-of-pocket expenses.”

Kliff writes, “Those with the most difficulty tended to be those who were bilingual or

Spanish-speakers, younger people and those with less than a high school

education. While these groups had the lowest rates of understanding,

that’s not to say that other demographics did great: Among those who

were college graduates, just over half felt confident in understanding

all nine terms. . . . The Blue Cross Blue Shield Association, for example, has launched an AskBlue Web site that’s pretty much aimed at educating consumers about these terms.”