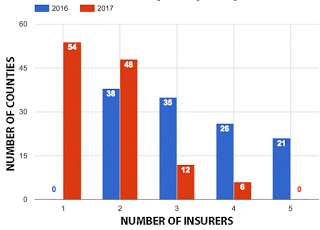

Almost half of Ky. counties will have only one insurer to choose from on government exchange; open enrollment begins Nov. 1

|

|

Base chart from Insider Louisville

|

Anthem Health Plans of Kentucky will be the only health insurer offering coverage for next year to Kentuckians on the government exchange in 54 counties. That is a sharp decrease from last year, when Kentuckians in all counties had at least two insurers, and most had three.

“The diminishing competition on health-care exchanges is not a local issue—it’s a national one,” Jean West, communications director for the state Cabinet for Health and Family Services, said in an e-mail. “As has been widely reported, insurers across the country have been losing hundreds of millions of dollars in the Obamacare exchanges and can no longer sustain such heavy financial losses. Insurers are left with the choice of increasing rates, reducing benefits or pulling out of the exchange markets altogether.”

USA Today reports that “up to 2.1 million people nationwide will likely have to change plans for 2017 due to insurers leaving states’ [Patient Protection and] Affordable Care Act marketplaces, up from more than 1.2 million who had to find new insurers last year.”

West noted that the failure of the Kentucky Health Cooperative has added further burden to the remaining insurers on the exchange. Prior to its demise in 2015, the cooperative sold 75 percent of the policies on the state’s health exchange, attracting many of the state’s unhealthiest people. These clients have since had to find new insurers who now must assume their risk.

“While CHFS and the Department of Insurance will continue to work with insurance providers to increase their offerings, any such efforts will continue to be handcuffed by market forces created under Obamacare,” West said.

|

| Screenshot of part of The Wall Street Journal‘s interactive map of exchange insurers. Light blue counties have one, medium blue two and dark blue three or more. Click here for the map and county data. |

Anthem is the only company offering statewide coverage on the exchange in 2017. Baptist Health, CareSource and Humana Health Plan will offer exchange plans in specific areas only.

In 2017, Baptist Health will offer exchange plans in 20 counties, up from 18 in 2016; CareSource will offer plans in 61 counties, up from 46 in 2016; and Humana will decrease the number of counties it serves to nine, down from 15 in 2016.

West confirmed that Kentuckians who sign up for health insurance through the exchange will enroll on Healthcare.gov this year, instead of Kynect, the state’s health insurance exchange. Open enrollment begins Nov. 1 and goes through Jan. 31.

United HealthCare, WellCare, and Aetna, which offered plans on the exchange in 2016, will not offer any state exchange plans in 2017. United will continue to offer small group plans outside the exchange and Aetna will continue to offer plans off the exchange, which means they will not be eligible for federal tax subsidies.

United, which offered plans in all 120 counties in 2016, announced in April that it would no longer participate in Kentucky’s exchange, citing unsustainable losses. A Kaiser Family Foundation analysis said that the effects of United’s departure would be “modest” in states where it did not offer low-cost “silver” plans. United did not offer such plans in Kentucky, where 60 percent of those who signed up through the exchange chose a silver plan in 2016.

Aetna withdrew from Kentucky’s exchange in August, also citing unsustainable losses. Its withdrawal affects 10 counties in three major metropolitan areas: Boone, Campbell, Kenton, Fayette, Madison, Jefferson, Oldham, Trimble, Henry and Owen counties.

WellCare’s withdrawal from the exchange will affect 12 counties: Boone, Bullitt, Campbell, Clay, Fayette, Harlan, Jefferson, Jessamine, Kenton, Laurel, Leslie and Warren counties.

USA Today notes, “Insurers need healthy people to buy insurance to offset the cost of covering the sicker ones,” but current premiums are too high for many healthy consumers to afford, especially if they don’t qualify for a subsidy.

Insider Louisville reports that Kevin Lucia, a senior research fellow and project director at the Center on Health Insurance Reforms at Georgetown University’s Health Policy Institute, said that before Obamacare “insurers made money by discriminating against sick people. Now, insurers have to make money with a diverse pool of customers, including some with very high risks for health services, and some are still figuring out how to properly price their policies.”

“It’s a totally different situation,” Lucia said. “We are just at the beginning” of health reform, he said. “This is a marathon.”