Study says removing Medicaid expansion and premium subsidies, without replacement, would cost 45,000 jobs in Kentucky in 2019

Kentucky Health News

Repealing and not replacing two key parts of the Patient Protection and Affordable Care Act – expansion of the Medicaid program and subsidies for private insurance – could cost 45,000 Kentuckians their jobs in 2019, according to a new study.

The study is from the Milken Institute School of Public Health at the George Washington University and The Commonwealth Fund, a New-York based research foundation that says it promotes “a high-performing health-care system.”

Republicans say they will soon “repeal Obamacare” but have been much less certain about what would replace it, and when. The study considers what would happen if Congress repeals and doesn’t somehow replace the premium tax credits that help low- and middle-income Americans buy insurance on government exchanges, and the federal payments to states that expanded Medicaid to those who earn up to 138 percent of the federal poverty level.

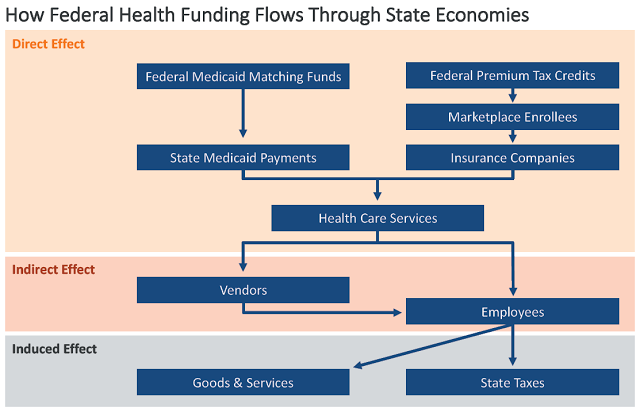

The study used an economic forecasting model based on federal spending for Medicaid expansion and tax credits that subsidize insurance policies on the exchanges, and on Congressional Budget Office budget projections, with a multi-region model to account for interstate activity.

The study abstract says, “If replacement policies are not in place, there will be a cumulative $1.5 trillion loss in gross state products [the sum of value added from all industries in each state] and a $2.6 trillion reduction in business output from 2019 to 2023. States and health-care providers will be particularly hard hit by the funding cuts.”

The study predicts that about one-third of the jobs lost in Kentucky would be in health care, but losses are also projected in construction, real estate, retail, finance, insurance and other industries. It forecasts that Kentucky’s gross state product would fall $22.9 billion from 2019 to 2023; business output would fall $40.6 billion; and state and local taxes would decrease by $718.3 million.

“Federal funding thus initiates an economic cycle that ripples throughout the economy, both within and across state borders,” the study report says. “The gains from this cycle also generate additional state and local tax revenues. When federal funds are cut, the results play out in the other direction, triggering losses in employment, economic activity and state and local revenues.”

|

| Chart from Commonwealth Fund report |

The study also considered the impact of repealing and not replacing each of the two provisions alone. It estimated 13,200 lost jobs in 2019 from the repeal of premium subsidies and 31,400 from the repeal of the Medicaid expansion.

The report says that repealing and not replacing the expansion and the subsidies would be “particularly detrimental” to health-care providers, causing safety-net facilities, such as public hospitals and community health centers, to be hit especially hard by having to provide care for which they would not be paid.

Through the Medicaid expansion and premium subsidies, Kentucky had the largest drop in low-income, working-age people without health insurance, falling from 38 percent in 2013 to 13 percent in 2015, according to a separate Commonwealth Fund report.

“We do have research showing it’s provided a great deal more access,” former U.S. Rep. Ben Chandler, president of the Foundation for a Healthy Kentucky, told Bill Estep of the Lexington Herald-Leader. “However, the Kentucky Hospital Association has complained about the law hurting hospitals’ revenue and forcing layoffs,” Estep noted. “On Thursday, Senate Majority Leader Mitch McConnell said the law has been a disaster,” citing increases in premiums and deductibles and fewer companies selling policies on the exchanges.

Commonwealth Fund Vice President Sara Collins told Estep that the issues that exist in the law with affordability could be fixed through legislation, and “The law is generally functioning very well.”

The report offers this caveat: “It is important to note that other health policy changes, or even changes to tax policy, could

modify our projections. We focus on these two repeal policies alone because it is not yet clear what additional policy changes might be advanced.”