Seniors can save lots of money by shopping around for Medicare drug plans, but few do; here are tips

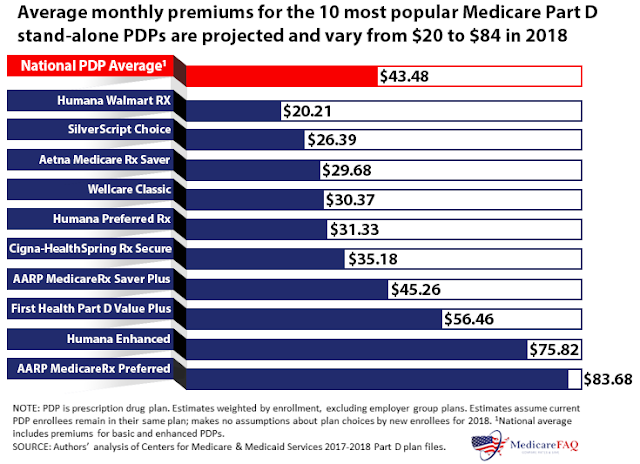

| Chart shows average premiums for most popular stand-alone Medicare prescription drug plans. |

Seniors could save millions of dollars by shopping around for Medicare drug plans, but few do, Trudy Lieberman writes for Rural Health News Service: “With drug costs climbing for seniors, careful shopping is important this open-enrollment season,” which for Medicare runs through Dec. 7.

And it can matter to a lot more people than it did before. “More than one million beneficiaries with drug benefits had spending above the threshold in 2015, more than twice the number in 2007,” Lieberman reports.

Still, few “shop and compare Part D plans, even though this year the average Medicare beneficiary has a choice of 27 stand-alone Part D plans,” for people in traditional Medicare, and 24 Medicare Advantage plans that include the drug benefit. Medicare.gov has a drug-plan finder to compare plans, but “Many people remain skeptical they can get a better deal, and may lack computer skills to find the best choice.” Also, a third of Medicare beneficiaries have cognitive impairments, Lieberman notes.

- Check for your regular drug(s) in the insurance plan’s tiers, preferred or non-preferred. A drug might be in one plan’s non-preferred tier but in another’s preferred tier, making it cheaper. Some drugs in the non-preferred tiers may require you to pay 50 percent of the cost. Specialty drugs have their own tier, usually with 33 percent consumer payment for non-preferred drugs.

- “Generic drugs might not be cheaper,” Lieberman writes. “A generic in the non-preferred tier might be more expensive than a brand-name drug in a plan’s preferred tier.”

- Does the plan requires “step therapy,” which means you must first try lower-priced drugs? Is preauthorization for services required? A Kaiser found that 80 percent of beneficiaries were in plans that required preauthorization for any service — including Part B drugs administered in a doctor’s office. “Many consumers find preauthorization a real hassle,” Lieberman notes.

- Talk with your health-care provider about cheaper alternatives. Maybe there is one in a plan’s preferred category. Prescribers “are often not knowledgeable about the ins and outs of drug plans, and may not have a patient’s financial wherewithal in mind when they write the prescription,” Lieberman writes.