Skyrocketing cost of insulin examined by legislative committee and research showing cost makes patients ration the hormone

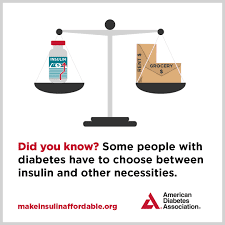

Advocates called on state lawmakers to find a way to make insulin more affordable, with several of them telling an all-too-common story of how they must ration their supplies because the hormone is too expensive, or of being forced to use a different product than their provider recommends because that’s the only one their health insurance will cover.

Angela Summers, 48, of Louisville, told the Interim Joint Committee on Banking and Insurance Aug. 21 that she struggled to pay for her insulin after moving back to Kentucky from New York in 2009, when the cost, with insurance, jumped from $35 a month to over $400 a month. She said that resulted in years of rationing that led to diabetes-related health issues that resulted in the amputation of her lower right leg in 2013.

“I could keep my lights on or I could pay for my insulin,” she said in a prepared statement for the committee. She said she often bargained with herself, saying, “I’ll make one month’s worth of insulin last three months . . . or I’ll just get it next month, which turns into six months.”

Summers told the group that she is now taking what she called an “outdated” and “inferior” type of insulin that she can buy at Walmart for about $25 a vial. She said this isn’t the type of insulin that her provider recommends, but is what her insurance will cover. “I use inferior insulin; because my insurance covers it, because I can afford it and because I’m not ready to die,” she said.

Gary Dougherty, chief state lobbyist for the American Diabetes Association, told the committee that Summers isn’t alone in her struggle, Jim Hannah reports for the Legislative Research Commission.

“Using less than the prescribed amount of insulin can result in uncontrolled glucose levels which can lead to damage to one’s eyes, kidneys and heart,” Dougherty said. “Ultimately, without enough insulin, diabetic ketoacidosis can occur. If untreated, it can lead to diabetic coma – or even death.”

Angela Laudner of Northern Kentucky, who uses three vials of insulin a month, told the committee that she bought a vial of her insulin in Canada for $22, while that same vial’s over-the counter retail price was $300 at the Costco in Newport, Tom Latek reports for Kentucky Today.

Dougherty gave the committee a list of facts about diabetes and insulin in Kentucky: 567,000 residents, or just over 15 percent of the state’s adult population, have diabetes; of those, an estimated 108,000 don’t know it. Another 1.16 million, or 35 percent of the adult population, have pre-diabetes. Each year, an estimated 130,000 Kentuckians are newly diagnosed with diabetes.

People with diabetes spend about 2.3 times more on health care than those who don’t, Dougherty said. In Kentucky, the total direct medical expense for diagnosed diabetes in 2017 was estimated at $3.6 billion. An estimated $1.6 billion was spent on indirect costs from lost productivity due to diabetes.

The Diabetes Association’s key legislative recommendations were to require transparency throughout the insulin supply chain; to lower or remove patient cost-sharing for insulin, such as capping co-pays for insulin or exempting it from the deductible; and to ensure that the value of co-pay assistance programs would apply toward a patient’s deductible.

Rep. Danny Bentley, R-Russell, introduced a bill during the last legislative session to address the rising cost of insulin that called for increased price transparency from drug manufacturers and pharmacy benefit managers. It didn’t make it out of committee.

Bentley pre-filed legislation in June, Bill Request 105, that would cap the insulin co-pay at $100 per month. It would not instruct the state attorney general to investigate insulin pricing, as a similar bill that recently passed in Colorado does. Several legislators said the legislature should give the attorney general power to investigate prices, Latek reports.

Attorney General Andy Beshear launched an investigation in March to find out whether pharmacy benefit managers have overcharged the state and discriminated against independent pharmacies. In July, he asked for more legal help to further this investigation. He has also filed lawsuits against three of the nation’s largest insulin makers to address the skyrocketing drug prices.

Pharmacy benefit managers are the middlemen between insurance and drug companies. They determine which drugs are offered, their prices and the payments to pharmacists.

Research shows cost makes patients ration insulin

A study released this month by the Centers for Disease Control and Prevention that looked at strategies adults with diabetes use to reduce their prescription drug costs. It found that in 2017 and 2018, nearly 18% of working-age adults with diabetes rationed their insulin by taking smaller doses, waiting to fill prescriptions, or skipping their insulin altogether.

The study found that among working-age adults, 36% of those without insurance said they were not filling a prescription because they did not have the money. Even among those with private insurance and Medicaid, respectively, 14% and 17.8%, said likewise.

Among adults of all ages in the study, 13% reported they didn’t take their medications as prescribed in order to cut cost.

A Yale University study shows that one in four patients with diabetes have reported using less insulin than prescribed due to its high cost, and that over a third of those patients said they had never discussed this reality with a health-care provider.

And the price of insulin keeps going up, with the average cost of an insulin prescription doubling between 2012 and 2016, according to the Health Care Cost Institute. Kentucky data from that report shows that the average point of sale price per prescription was $352 in 2012, rising to $721 in 2016. The report found the average national price increased from $344 in 2012 to $666 in 2016.

The CDC study concludes: “In 2018, medications to treat diabetes ranked sixth out of the top 20 therapeutic classes of dispensed prescriptions, accounting for 214 million prescriptions. In 2017, the annual per capita expense for outpatient medication for those with diagnosed diabetes was almost $5,000. . . . The burden associated with high prescription drug costs remains a public health concern for adults with diagnosed diabetes.”