Poll: 3 of 4 Kentuckians say they worry about affording health care

Chart from poll report; for a larger version, click on it

—–

By Melissa Patrick

Kentucky Health News

Kentucky Health News

More than half of Kentucky adults struggled to pay for health care in the past year, and three out of four were worried about paying for it in the future, according to a Altarum Healthcare Value Hub survey, done in collaboration with the ThriveKY Campaign.

In the survey of 1,140 Kentucky adults, taken May 8-26, 58 percent said they had experienced one or more health-care affordability burdens in the past year, with 18% reporting they had been uninsured at some point in the prior 12 months and 39% of that group saying they lacked coverage because it was too expensive.

The reality of those concerns are likely high for many Kentuckians during this record year of unemployment, in which many Kentuckians have also lost their health insurance.

“More than 233,000 Kentuckians have lost employer-sponsored health insurance along with their jobs,” Emily Beauregard, executive director of Kentucky Voices for Health, said in a news release.

One option for many who have lost their coverage in Kentucky has been Medicaid, the federal-state plan for low-income and disabled people. It was expanded in 2014 under the Patient Protection and Affordable Care Act to include those who earn up to 138% of the federal poverty level and may not have been able to afford the ACA’s subsidized marketplace plans.

When the pandemic hit, the state made Medicaid enrollment easier, and Kentucky has led the nation in the rate of people gaining Medicaid coverage during the pandemic, according to a July 24 report by the Kaiser Family Foundation. It found that Kentucky Medicaid, which now covers more than 1.5 million people, grew 7% from March to April.

”Legal-aid offices around the state for years have seen Kentuckian families crushed by debt to the point of bankruptcy, and too often plagued by collection practices,” Kentucky Equal Justice Center Director Rich Seckel said in the release. “Medicaid expansion and marketplace plans made a big difference, but families worry that the coverage may end. And many recently lost their employer-sponsored coverage.”

Just over half of those surveyed, 51%, said they had encountered one or more cost-related barrier to getting health care in the past 12 months. Of that group, 30% had delayed going to the doctor or having a procedure done; 29% had skipped needed dental care; and 24% had skipped a recommended medical test or treatment.

Other delays due to cost were: going to the doctor or having a procedure done altogether, 24%; not filling a prescription, 23%; cutting pills in half or skipping doses of medicine, 20%; and having problems getting mental-health care, 12%.

And even if they could get health care, 32% of Kentucky adults said they struggled to pay for it. Of this group, 14% said they had been contacted by a collection agency; 9% said they had used up all or most of their savings; 8% said they had been unable to pay for basic necessities; 8% said they had to borrow money or get another mortgage on their home; 7% said they had racked up large amounts of credit-card debt; and 7% said they had been placed on a long-term payment plan.

“Amidst the covid-19 crisis, Kentucky residents are critically concerned about health-care affordability and believe their elected officials should act to address these problems,” said Amanda Hunt, co-deputy director of the Healthcare Value Hub. “We found that even when respondents got the care they needed, one out of three Kentucky adults struggled to pay the resulting bill. Solutions received widespread support across party lines.”

The survey found that 77% of Kentucky adults are concerned about affording health insurance in the future. Their worries included the cost of prescription drugs or dental care; the cost of long-term care or home care, or rising medical cost when they grow old; or the cost of of a serious incident or accident.

And regardless of their coverage type, 61% of the respondents said they were worried or very worried about not being able to afford health insurance in the future.

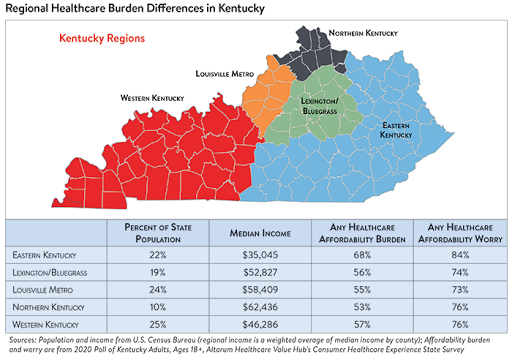

The survey found some regional differences in how Kentuckians experience health-care burdens. Eastern Kentucky adults reported the highest level of affordability burden, 68%; and affordability worry, 84%. Northern Kentucky adults reported the least amount of cost burden, 53%; and Louisville Metro reported the least amount of worry over cost, 73%.

The survey included several questions about the coronavirus. Asked if they were worried about “affording treatment of coronavirus/covid-19 if you need it,” 59% said they were worried or very worried.

They were asked to pick their top three worries regarding covid-19 from a list of 12. Twenty-one percent said they were worried that “you or a family member becoming ill from covid,” 11% were worried about job loss and resulting lack of wages, and 9% each were worried about the decreased value of their retirement savings and an inability to get treatment for other health problems.

Dissatisfaction with the current health-care system was both statewide and bipartisan, with 71% of the respondents agreeing or strongly agreeing that the system needs to change; only 27% said “We have a great health-care system in the U.S.”

|

| Chart from poll report; for a larger version, click on it |

And when asked what issues the government should address in the upcoming year, 69% said health care. Some of the top votes on a long list of what the government should work on were: drug companies charging too much money, 74%; hospitals charging too much, 69% and insurance companies charging too much, 65%.

Some of the top strategies to tackle cost, according to the respondents, included expanding health-insurance options so that everyone can afford quality coverage, requiring insurers to provide up-front cost estimates to consumers, and to show what a fair price would be for a specific procedure.

The respondents were also asked about covid-19 policy. The report said, “There was significant diversity in the policies supported, with the front runner, additional federal stimulus payments, closely followed by four almost equally ranked options: more financial help for small businesses, improved public-health emergency preparedness, universal health coverage, and price limits on needed vaccines. The least supported policy was “More financial help for large businesses.”