McConnell puts fix for ‘surprise billing’ problem in must-pass bill

The massive bill to keep the government open and provide $900 billion in pandemic relief also includes a compromise solution to the nagging problem of “surprise billing” in health care, key members in both parties said Sunday night.

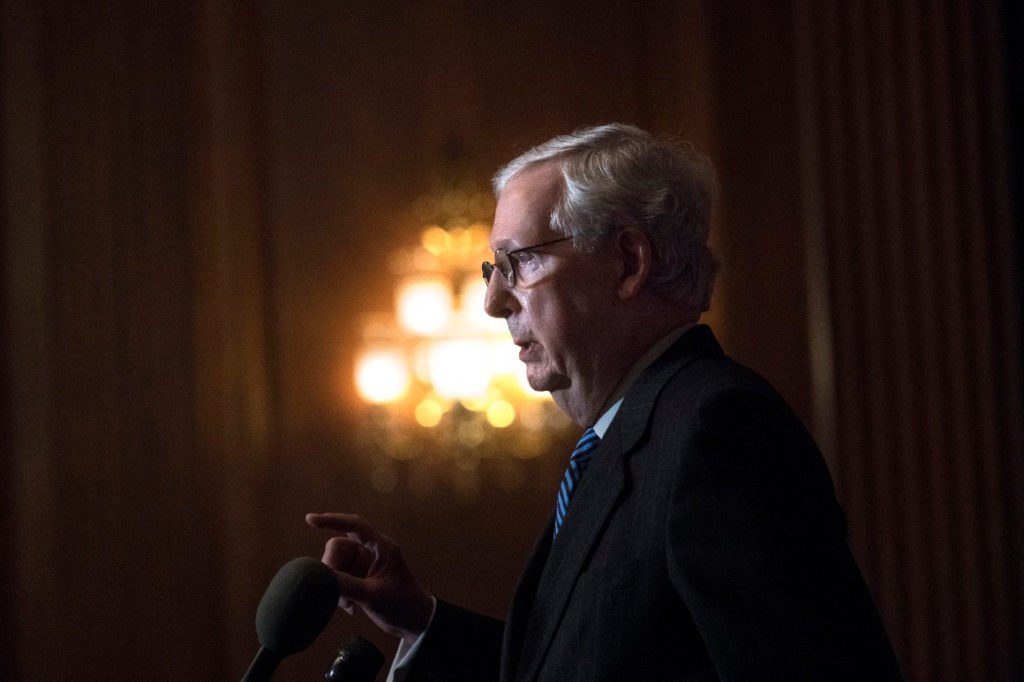

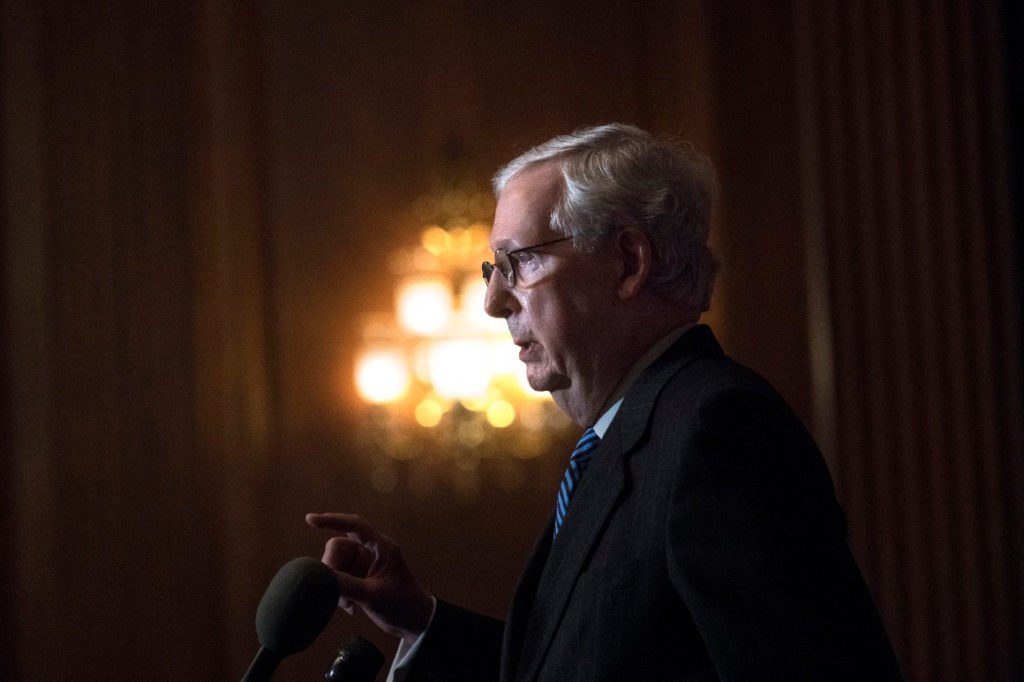

Senate Majority Leader Mitch McConnell, who was pulled in opposite directions on the issue and had remained mum about it, made the final call, Susannah Luthi of

Politico reports.

“While the health-care industry agreed that patients should be held harmless in emergency situations, hospital and physician groups and insurers fought vigorously over who would pick up the tab,” Luthi reports. “The

compromise deal congressional committees struck earlier this month was considered largely a win for hospitals and doctors —and tweaks made in the final legislation are even friendlier to providers, according to a summary obtained by Politico.”

The key change is in the negotiation procedure for health-care providers and insurance companies to resolve billing disputes or take them to a mediator. “The bill would forbid arbiters from taking into account Medicare and Medicaid rates, which are typically much lower than what commercial coverage pays,” Luthi writes. “That is a loss for insurers, employers who fund a major chunk of private coverage, and patient advocates who thought including those public rates as a barometer could help curb health-care prices. As a guardrail, the measure also bars arbiters from considering providers’ billed charges, which are usually well out of line with what insurers or patients end up paying.”

Surprise billing usually happens when a patient is treated by a provider, or transported by an emergency medical service, that is not in the network called for by the patient’s insurance. Contracted emergency-room physicians are a common case; as many as

one in five ER visits can result in a surprise bill. “Some private-equity firms have turned this kind of billing into

a robust business model, buying emergency room doctor groups and moving the providers out of network so they could bill larger fees,”

The New York Times reports.

Surprise billing is a problem in Kentucky. “A 2018 survey found that 32% of privately insured Kentucky adults reported receiving a medical bill that included an unexpected expense in the previous year,” Butler County Republican Party Chair Matthew Embry wrote in a Dec. 2 piece for the Courier Journal. “To make matters worse, 70% of patients who were hit with surprise medical bills had no idea they were receiving treatment from a provider outside of their insurance network. . . . If the patient can’t afford to pay astronomical surprise bills, they can be harassed by collection agencies, threatened with legal action and even forced into bankruptcy.”

The bill’s passage is a big capstone for the political career of retiring Sen. Lamar Alexander, R-Tenn., a

close friend of McConnell. But one of the majority leader’s biggest business constituents is

Humana Inc., the Louisville insurance firm.

Insurers did appeared to get something in the final deal, Luthi reports: “Lawmakers appear to have watered down a measure that would have required them to disclose detailed information to employers about their drug costs and rebates through their contracts with middlemen known as pharmacy benefit managers, whose business practices have come under scrutiny in recent years for their role in high drug costs. Instead, the legislation calls for insurers to submit more general information on medical costs and prescription drug spending to relevant federal agencies, which would feed into a government report on drug pricing trends.”

The U.S. Supreme Court recently ruled that states could regulate pharmacy benefit managers, which the Kentucky legislature recently

decided to regulate, partly in an effort to help independent pharmacies deal with competition with pharmacy chains than operate PBMs.