By Melissa Patrick

Kentucky Health News

A new poll shows that nearly three-fourths of registered voters in Kentucky support a statewide excise tax on electronic cigarettes. Currently, e-cigarettes are subject only to sales tax in Kentucky, while traditional cigarettes carry both a sales tax and excise tax.

Kentucky was about to pass a 15 percent excise tax on e-cigarettes during the last legislative session, but after a visit from Altria Group‘s chief lobbyist, leaders of the state Senate removed the tax from a bill that ultimately raised the state cigarette tax 50 cents a pack, to $1.10. Altria is reportedly buying 35 percent of Juul, the e-cig maker that has three-fourths of the market.

The Mason-Dixon Polling and Research, Inc. poll, taken Dec. 12-15, found that 73 percent of Kentucky voters supported a state excise tax on e-cigarettes, while 21 percent opposed such a tax, and 6 percent were undecided.

Support for the tax was bipartisan, with 77 percent of Republicans and 72 percent of Democrats and 62 percent of independents for it.

“E-cigarette sales are accelerating globally, nationally, and in Kentucky, and given both our state budget situation and this overwhelming level of bipartisan support from voters, there’s every fiscal and political reason to treat them the same way as other tobacco products,” Ben Chandler, president and CEO of the Foundation for a Healthy Kentucky, said in a news release. The foundation paid to put two questions in the poll.

Among the 16 percent of Kentucky adults who said they had tried electronic cigarettes, 53 percent opposed the tax, 37 percent supported it, and 10 percent said they were undecided. Teenagers were not polled, but their use of the vapor products has exploded.

Federal research released in November showed a 78 percent increase in vaping among high-school students between 2017 and 2018, with the number of vapers surpassing 3 million. The same report showed vaping by middle schoolers increased 48 percent from the year before.

The problem is so widespread that the surgeon general has called teen vaping an epidemic, prompting him to release a rare national advisory stressing the importance of protecting children from e-cigs, which are setting them up for a lifetime of nicotine addiction and associated health risk.

“This explosive growth is erasing years of progress in reducing tobacco use among adolescents and teens and creating a whole new generation of Kentuckians who will have to deal with the expensive, debilitating and often deadly diseases tied to tobacco consumption,” Chandler said. “The research shows that one of the most effective ways of reducing tobacco use — especially among youth, pregnant women and those living on low incomes — is raising the cost of the tobacco products.”

According to the federal Centers for Disease Control and Prevention, 100 percent smoke-free policies, hard-hitting media campaigns, access to proven cessation products and tobacco price increases are proven strategies to decrease tobacco use.

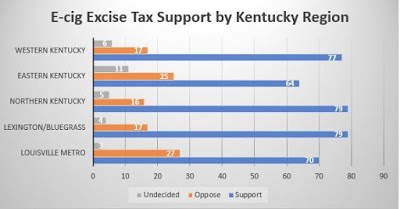

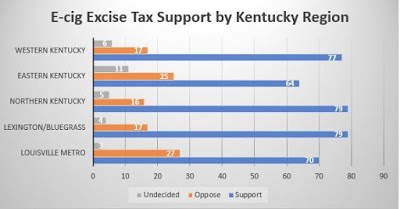

The poll found support for an excise tax was strong across the state, with the strongest support in the Bluegrass and Northern Kentucky (79 percent), followed by Western Kentucky (77 percent) and Louisville Metro (70 percent). Eastern Kentucky, the region that reported the highest use of e-cigarettes, 21 percent, had the lowest support for the tax: 64 percent.

Support was slightly higher among men than women, 76 percent and 70 percent, respectively. It was highest among older Kentuckians, with 79 percent of voters between 50 and 64 supporting the tax, followed by 76 percent of those 65 and older, and 75 percent of those between 35 and 49.

Only 56 percent of Kentucky voters between the ages of 18 and 34 supported an e-cigarette tax, no surprise since the poll also found that 41 percent of this group had tried the devices. Vaping was reported by 13 percent of those 35-49, 12 percent of those 50-64; and 7 percent of those 65 and older.

The poll surveyed a total of 625 registered Kentucky voters via both land-line and cell-phone numbers. The margin for error in any statewide figure is plus or minus 4 percentage points, and higher for the regional, partisan and demographic groups.

Nine states and the District of Columbia have imposed an excise tax on e-cigarette sales, according to the news release.

A spokesman for Senate President Robert Stivers said he had no comment on this matter at this time.

In a statement issued Thursday, Altria said: “Altria’s tobacco operating companies oppose excise tax increases which fund general government programs that benefit many while placing the economic burden solely on adult tobacco consumers. This is particularly true in Kentucky, where cigarettes were the only consumer good targeted with an excise tax increase in 2018, and increasing taxes on e-cigarettes is just an extension of the same unfair policy.”