As income taxes are filed, half who got Obamacare subsidy will have to pay part of it back; almost as many will get a refund

Kentucky Health News

This week will go down in history as the first time the Internal Revenue Service enforced the Patient Protection and Affordable Care Act’s tax penalty for those who can afford insurance but didn’t buy it.

The penalty for those who don’t qualify for an exemption is $95 per adult and $47.50 per child, or 1 percent of your income, whichever is larger. The penalty will increase next year to the greater of $325 per adult or 2 percent of household income.

“Ever since its passage, the mandate that every American have health insurance has been at the heart of the controversy over the ACA,” Elaine Kamarck writes for the Brookings Institution. It was an issue long before the law passed; in the 2008 presidential primaries, Hillary Clinton favored it and Barack Obama opposed it; as president, he changed his mind.

Tens of thousands of Kentuckians who got subsidies to help pay for their health insurance through the Kynect exchange will probably be surprised to find that they will have to repay some of the subsidy, or that they will get a refund, depending on the difference in their actual income level and the income that was recorded at the time they bought insurance. Most incomes were likely based on an estimated income for the year. Generally, if you overestimated your 2014 income, you will get a refund. If you underestimated it, you will have to repay some or all of the subsidy, which was subtracted from the “sticker price” of insurance to calculate your premium.

|

|

Infographic from Kaiser Family Foundation

|

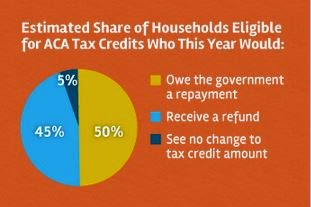

A study by the Kaiser Family Foundation estimates that 50 percent of Americans who got 2014 tax subsidy will owe some money, and 45 percent will receive a refund. The foundation estimates the average repayment will be $794 and the estimated average refund to be $773.

John Ydstie of NPR reports some real examples of policyholders facing these surprises. He tells the story of one person who makes $30,000 a year who decided to take less than her estimated $250-a-month premium subsidy because of her uncertainty about the program, and is getting a $3,900 refund. He notes that most people on Obamacare can’t afford to do this.

Ydstie also tells the story of a young woman whose monthly subsidy dropped to $60 from $250 after she married her longtime partner in 2014 and their combined incomes bumped them into a different category. They have to pay back $1,800 but are hoping the amount will be adjusted to $400, to apply only to the months they were married; this has not yet been determined.

As the IRS implements the law, it is faced with budget, staffing, and operational cuts, Kamarck writes: “Given the staff limitations of the IRS and the complexity of reporting and reconciling the government subsidies in the law with people’s income there is likely to be confusion, frustration and, most importantly, a lot of people who find out that their tax refund is a great deal smaller than they anticipated.” She suggests that the IRS, in order to survive the first tax season with the ACA, “give taxpayers a break whenever it can.”