Half of rural hospitals lose money; firm says 418 could close; Ky. not a leader except in Medicare Advantage, which is a threat

Kentucky Health News

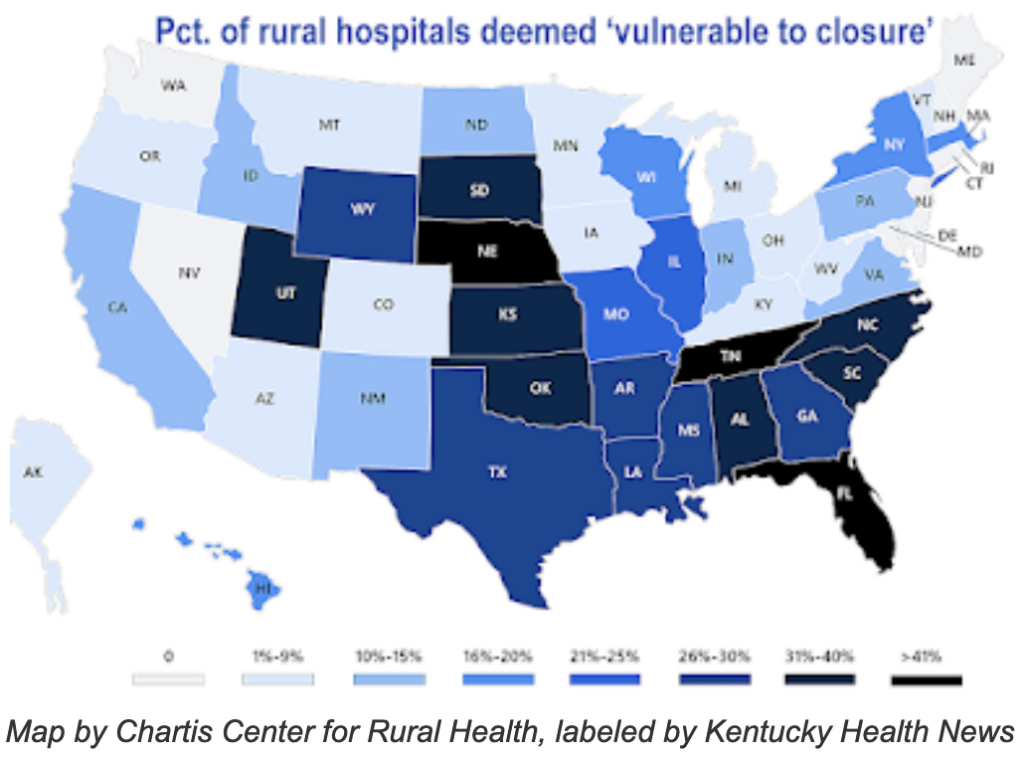

Rural hospitals are in more trouble than ever, and 418 of them are “vulnerable to closure,” according to a study of their finances by Chartis, a Chicago-based health-care consultancy that specializes in tracking the business of rural health.

The Chartis Center for Rural Health says rural hospitals are entering “a startling new phase of this crisis as rural hospitals fall deeper into the red, ‘care deserts’ widen throughout rural communities, and the increasing penetration of Medicare Advantage could further disrupt rural hospital revenue.”

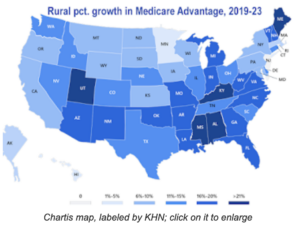

Most people on Medicare now have Medicare Advantage, private insurance plans that get lump sums from Medicare to cover members and look for ways to attract customers while limiting claims. “Medicare Advantage now accounts for 35% of all Medicare-eligible patients in rural communities,” Chartis reports, saying Advantage plans’ share of rural residents has risen 48% since 2019.

That’s a problem for rural hospitals designated as “critical access” because Medicare Advantage plans’ net reimbursement to such hospitals “is often lower for similar services than that of traditional Medicare because Medicare Advantage does not follow cost-based reimbursement” as traditional Medicare does for such hospitals, Chartis reports. Insurance companies negotiate those rates with hospitals, and in many rural areas, hospitals are at a negotiating disadvantage because few insurers operate in their service areas.

That’s a problem for rural hospitals designated as “critical access” because Medicare Advantage plans’ net reimbursement to such hospitals “is often lower for similar services than that of traditional Medicare because Medicare Advantage does not follow cost-based reimbursement” as traditional Medicare does for such hospitals, Chartis reports. Insurance companies negotiate those rates with hospitals, and in many rural areas, hospitals are at a negotiating disadvantage because few insurers operate in their service areas.

Also, “Medicare Advantage may not cover all the services traditional Medicare does, including swing beds, which provide skilled nursing care for patients and are often a strong source of revenue stability for rural hospitals,” Chartis notes. “Rural providers may not be equipped to efficiently navigate administrative requirements for payment introduced by Medicare Advantage, such as prior authorizations, which can lead to increased denials.”

Since 2010, “167 rural hospitals have either closed or converted to a model that excludes inpatient care,” Chartis says. The firm says its estimate that 418 are “vulnerable to closure” is based on “a new, expanded statistical analysis” of their finances, gleaned from cost reports they file with Medicare.

The report does not give details for each state, but places each one in certain ranges. It deems fewer than 10% of Kentucky rural hospitals “vulnerable to closure” but places the state in the highest range of rural Medicare Advantage growth. As for being in the red or the black, it puts Kentucky among the states where 41% to 60% of the rural hospitals are losing money.