UK Healthcare says it must get even bigger, and expand its market area, to provide needed services to Kentucky

Kentucky Health News

The University of Kentucky‘s health-care system has grown by leaps and bounds in the last decade, becoming one of the state’s largest businesses, but its boss says it must expand its geographical reach to maintain its newly raised national status and to ensure access to quality care for Kentuckians.

Over the last decade, UK HealthCare’s caseload has increased 85 percent, and its annual hospital budget has increased from $300 million to $922 million, Dr. Michael Karpf, executive vice president for health affairs, said in an interview.

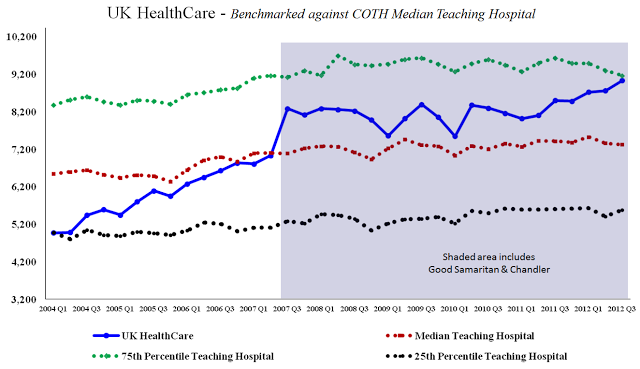

This explosive growth, in addition to the growth of the UK medical school, has jacked up the enterprise’s national ranking. It has grown from about the 85th largest academic hospital in the U.S. to approaching the 35th largest in terms of total discharges, the benchmark it uses. That means it has jumped from the bottom third to the top third in less than a decade. (For a more precise measurement over time, based on a Council of Teaching Hospitals standard, see chart.)

The push for growth and development began in 2003, after UK’s caseload hit a plateau even though the 1998 General Assembly had mandated it to become a top 20 public research institution. Karpf came aboard and combined the Chandler Medical Center, clinics, faculty practice plans and the College of Medicine into a single integrated system of care — branded as UK HealthCare — which he commands. Good Samaritan Hospital in Lexington was added in 2007.

“We want the hospital to be the first choice when it comes to complex care,” he said. “We must advance to better serve the health-care needs of Kentucky.” To do this, he said, UK HealthCare is rejuvenating its brand as “Kentucky’s Best Hospital,” with a broad range of advanced specialties to keep Kentuckians from leaving the state for care, and is moving to expand its geographic reach to Western Kentucky and out-of-state markets.

Karpf said UK must expand because its traditional market, approximately the eastern half of the state, is not large enough to provide the number of cases that UK will need to receive certification as a federal “Center of Excellence” for complex services like brain surgery and heart, liver, kidney and lung transplantation. He said such a designation will be necessary to get enough referrals from doctors and smaller hospitals to maintain these services and to guarantee that Kentuckians can get the care they need inside the state. “What we make money on is the complex stuff,” he said.

Unless UK secures half the available business from out-of-state competitive areas over the next 10 years, Karpf said, “It becomes an issue of access for Kentuckians.”

He said the out-of-state institutions that are large and advanced enough to effectively compete with UK as a major referral center include Vanderbilt University, Washington University in St. Louis, Indiana University, Ohio State University, Cleveland Clinic, the University of Pittsburgh Medical Center and the University of Virginia. Vanderbilt is the nation’s 10th largest academic medical center and gets many patients from Western and Southern Kentucky.

|

| UK HealthCare map shows out-of-state markets and institutions it targets for its expansion. |

What about Louisville, Cincinnati, Knoxville and other cities? Karpf said the University of Louisville, the University of Tennessee, the University of Cincinnati and West Virginia University are too small and too far behind to be Centers of Excellence. U of L’s hospital ranks 88th in total discharges among academic medical centers.

All hospitals are facing challenges from federal health-care reform, but Karpf said at UK it has prompted a culture change centered on quality of care, which the reform law is designed to reward. As UK tries to expand its market, he said, it is critical to stay focused on, safety, service and patient satisfaction. One issue Karpf is dealing with now is the hospital’s cardiothoracic surgery program for children, which has been suspended pending an internal review.

As UK seeks more referrals, Karpf said, it is building better relationships with smaller hospitals. “in the past, academic medical centers have been seen as predatory,” he said. “We concluded that we need to be seen as in another line of business. . . . We have very strong relationships with community hospitals in Western Kentucky.”

For example, UK is training a cardiologist who is dedicated to practicing in Paducah once his training is complete, and kidney specialists from the area are in its transplant network. The specialists evaluate patients, send them to Lexington for transplants, and provide follow-up care upon their return. Such coordination helps community hospitals keep patients and recruit professional staff, and helps UK capture the cases it might lose to Vanderbilt and other out-of-state hospitals.

Baptist Hospitals Inc. has a large facility in Paducah and recently bought the Trover Health System hospital in Madisonville, making Baptist the largest hospital system in Kentucky, but Karpf said UK has a strong relationships with Baptist and the Norton Healthcare hospitals in Louisville. “They do not compete with us for complex care,” he said. “We don’t go after the bread-and-butter cases.”

Complex care, for which insurance companies pay well, accounts for 5 to 7 percent of UK’s cases but almost all its profits. Karpf said UK loses money on another 5 to 7 percent and breaks about even on the rest. He said the profits are invested in buildings, technological equipment and attracting nationally recognized specialists.

The most visible evidence of that is the hospital’s new bed tower, part of $1.4 billion UK Healthcare has spent revitalizing itself, mostly with its own profits. But the larger impact is probably in expansion of good-paying jobs.

|

| Dr. Michael Karpf |

“We’ve been the most important growth engine in this region,” said Karpf. UK HealthCare went from paying $350 million in salaries and benefits in 2004 to more than $700 million last year. The College of Medicine went from 1,810 employees in 2004 to 2,337 in 2012. The hospital grew from 2,562 full time employees in 2004 to 5,544 in 2012, a 116 percent increase.

The medical school’s full-time faculty has expanded from 443 a decade ago to 625 now. “We know the stronger you are clinically, the better your research profile,” Karpf said. UK Healthcare hopes to achieve National Cancer Institute designation for the Markey Cancer Center, and it must continue to evolve in its clinical, education and research missions, Karpf said.

If UK HealthCare can do that, it will continue to be a major economic driver for Kentucky while ensuring that all Kentuckians have access to quality care.

Kentucky Health News is an independent news service of the Institute for Rural Journalism and Community Issues at the University of Kentucky, with support from the Foundation for a Healthy Kentucky.