Coalition: ‘Big Beautiful Bill’ will result in ‘deep’ safety net cuts; says proposed cuts to provider taxes are harmful

By Melissa Patrick

Kentucky Health News

A coalition that works to meet the basic needs of Kentuckians provided an update June 17 on state and federal policies that impact the state’s safety net programs, with much of the discussion focusing on how the U.S. House-passed budget reconciliation bill would harm such programs.

Emily Beauregard, executive director of Kentucky Voices for Health, which co-leads the ThriveKY coalition with the Kentucky Center for Economic Policy, opened the meeting by saying the proposed cuts to Medicaid in the House’s version of the bill would result in “deep, deep cuts to basic needs, to our safety net.”

The U.S. House reconciliation bill, known as the “One Big Beautiful Bill Act,” passed May 22 by one vote. It now awaits a vote in the U.S. Senate.

The nonpartisan Congressional Budget Office estimates that the House-passed reconciliation bill would reduce federal Medicaid spending by $793 billion over 10 years and that the Medicaid provisions would increase the number of uninsured people by 7.8 million, KFF, formerly known as Kaiser Family Foundation, reports.

In summary, Beauregard estimated that if the “One Big Beautiful Bill Act” passes, on the low end, 200,000 Kentuckians would lose their Medicaid coverage.

Further, she said it is estimated that the increase in cost to marketplace plans, sold on Kynect in Kentucky, would result in 47,000 Kentuckians losing their marketplace coverage and 53,000 more would pay more for their health plan.

When it comes to SNAP, or the Supplemental Nutrition Assistance Program, she said it is estimated that the state could see 50,000 Kentuckians losing this benefit and 93,000 more getting fewer benefits.

The bill would also impact the child tax credit and the earned income tax credit.

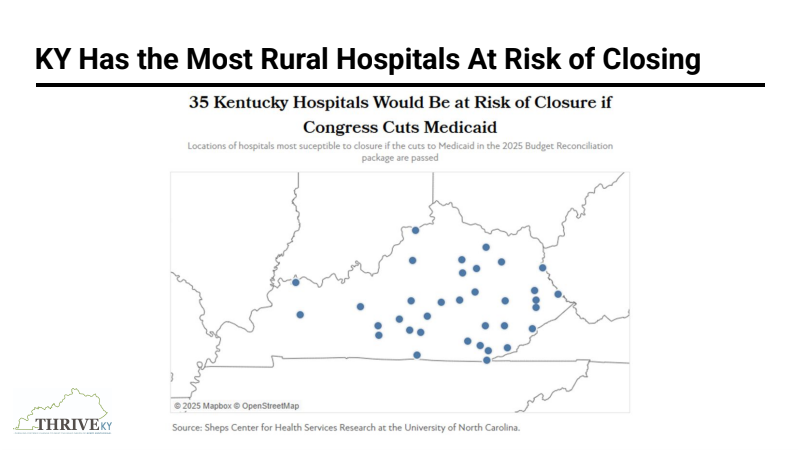

Beauregard also noted that the changes made in the Senate’s version of the bill, especially around Medicaid provider taxes, could be devastating to the state’s 35 rural hospitals that are at risk of closure if the “One Big Beautiful Bill Act” is passed.

“What we know is that the Senate version of this bill is even more harmful than the House version,” she said. “Kentuckians stand to lose really, really big.”

Beauregard was referring to research from the Cecil G. Sheps Center at the University of North Carolina at Chapel Hill that estimates 338 rural hospitals nationwide are at risk of closing under the proposed Medicaid cuts in the “One Big Beautiful Bill Act.” Of those, 35 are in Kentucky, more than any other state. KYPolicy offers a list of the at-risk hospitals and an analysis of the research.

The Senate version of the bill would gradually reduce the maximum amount of provider taxes allowed in states that expanded Medicaid, from 6% to 3.5% by 2031. The House bill would block new provider taxes.

Provider taxes, considered a loophole by some, are used to help states fund a portion of the state’s Medicaid program by allowing the money to be used to draw down additional federal matching funds for Medicaid. Kentucky, like so many other states, has benefited from these taxes.

In Kentucky, the Hospital Rate Improvement Program, which uses a hospital provider tax to fund it, is touted as a huge success. This program allows Kentucky’s inpatient and outpatient hospitals to be paid an average commercial rate for all Medicaid patients, instead of the current Medicaid rate, which is often below that amount. The additional funding provided by the HRIP program comes at no cost to the state because hospitals provide the state match through a provider tax.

Nancy Galvagni, president and CEO of the Kentucky Hospital Association, told the Jan. 9 House Health Services Committee that without the HRIP program, Kentucky’s hospitals would be operating at a negative 6% operating margin, which would result in less access to treatment and services for the people of Kentucky.

KHA has voiced support for the House version of the bill. A KHA spokesperson said it did not have anyone available to talk about why it supports the House version of the bill, but said its statement published last week on WKYT-TV is still correct.

The statement read: “The Kentucky Hospital Association endorses the Big Beautiful Bill Act (H.R. 1), as passed by the U.S. House of Representatives. The bill, as passed by the House, protects the Kentucky Medicaid program, which means that our patients will continue to have access to the care they need, when they need it. If the bill does not pass the Senate, there is a strong likelihood that our Medicaid patients will not be able to access all of the services our hospitals currently provide. We have called on the U.S. Senate to concur in the House Medicaid provisions.”

In an email, Beauregard reiterated her concerns about the proposed provider tax changes in the latest Senate version of the bill Senate, saying, “The biggest and most harmful change in the Senate version is around provider taxes and directed payments — our hospitals stand to lose billions annually and that would impact access to care for everyone, but particularly those 35 rural hospitals that are most at risk of closure.”

Directed payments allow states to set a required provider payment amount for Medicaid managed care organizations, which provide health care services for most Medicaid recipients.

Beauregard also noted that because provider taxes impact “directed payments that help to increase provider rates,” this also impacts jobs.

“We are seeing estimates that we would be losing anywhere between 12(000) and 24,000 jobs because fewer providers would be able to continue to practice and to cover their bills,” she said.

The Congressional Budget Office has not yet issued an analysis for the Senate version of the “One Big Beautiful Bill Act.”