Increasing Kentucky’s cigarette tax by $1.50 a pack would decrease youth smoking, Cancer Society lobbyist writes

“In the first full year following an increase in the tax by $1.50 per pack, it’s estimated that youth smoking would be reduced by about 17 percent and nearly 38,000 kids would never become adult smokers because most would never start,” Erica Palmer Smith, said in a statement.

“In the first full year following an increase in the tax by $1.50 per pack, it’s estimated that youth smoking would be reduced by about 17 percent and nearly 38,000 kids would never become adult smokers because most would never start,” Erica Palmer Smith, said in a statement.

She noted that research finds that the increase in the price of tobacco products must be high enough to deter use and that tax increases of less than a dollar a pack are easily absorbed by the tobacco industry through things like discount programs.

Kentucky has the third highest youth smoking rate in the nation, with 17 percent of its high school students smoking. Palmer Smith, who is an aunt to four high schoolers, writes that an estimated 3,200 of Kentucky’s youth under the age of 18 will become daily smokers.

“Almost all people who become lifetime tobacco users begin before graduating high school,” she said. “And, almost nobody tries smoking for the first time after the age of 18.”

A $1.50 increase “would convince approximately 45,000 current adult smokers to quit, generate more than $327 million in new revenue and save an estimated $9.28 million in Medicaid costs over a five-year period,” she writes. “Tobacco remains the number one cause of preventable death in Kentucky. . . . The best way to reduce death and disease caused by tobacco use is to keep kids from ever starting to smoke in the first place.”

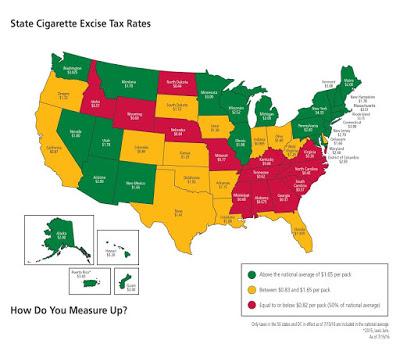

Kentucky’s tobacco tax hasn’t been raised since 2009. The tax ranks 43rd among the states; the average tax is $1.65 per pack.